Smart Invest can help make your money work harder and makes investing easy. With the support of experts you can take control of your financial goals. Smart Invest is provided jointly by our partners Irish Life Assurance, who provide the product, and PTSB, who provide the advice.

Unlike other types of investments, there's no need to spend your time picking funds and managing them to try to get the best return. With Smart Invest experts do the heavy lifting so you can rest easy.

The Smart Invest digital platform allows you to invest in a FlexInvest plan. To invest using Smart Invest, you must meet the eligibility criteria outlined here. Investors will be subject to checks required under Anti-Money Laundering laws and will be asked to provide documents including a copy of their passport and a utility bill.

| You must be | You must not be |

|

Between the ages of 18 and 69 |

A U.S. citizen |

|

Living in the Republic of Ireland |

A politically exposed person (PEP) |

|

A tax resident only in the Republic of Ireland |

A relative or a close associate of a PEP |

FlexInvest is a lump-sum unit-linked life insurance plan. This means your investment is used to buy units in one of 3 funds, each with a different level of risk.

After answering a few questions to determine your risk appetite and following the steps below you can start investing with ease.

Smart Invest is currently only available to existing PTSB customers. In some circumstances you may be required to visit a PTSB branch to verify your identity.

Irish Life Investment Managers are the appointed investment manager for Irish Life MAPS funds. They put your investment ‘eggs’ in lots of different baskets (the technical term = a multi asset portfolio (MAP)). This helps lower the risk that naturally comes with investing.

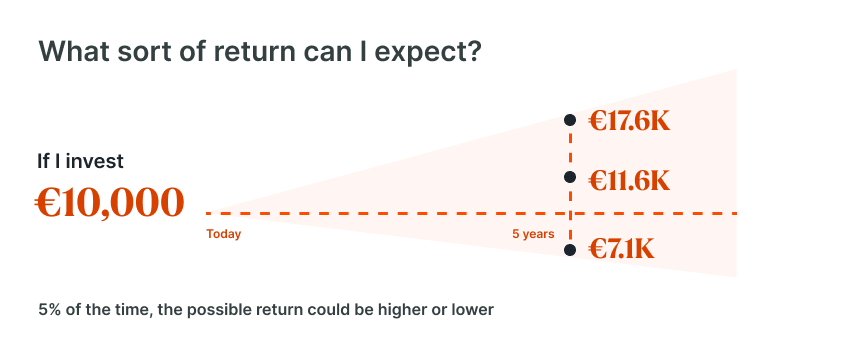

Investing can provide a range of returns, depending on the investments you make and market conditions. Let’s look at an example of a €10k investment with the Balanced Investor plan over a 5 year period*. 95% of the time the possible range of returns over the time period shown is expected to be within the range of the blue area on the graph.

This means that 5% of the time, the possible return could be higher or lower than the blue area. While this graph shows possible returns if things go badly or very well, it is more likely that your investment will see a return closer to the middle of the blue area.

*Calculations by Irish Life Investment Managers and returns are calculated before performance fees, taxes, and product charges.

Warning: If you invest in this product you may lose some or all of the money you invest.

Warning: The value of your investment may go down as well as up.

Warning: These funds may be affected by changes in currency exchange rates.

Warning: Past performance is not a reliable guide to future performance.

Warning: These figures are estimates only. They are not a reliable guide to the future performance of this investment.

Permanent TSB plc. is tied to Irish Life Assurance plc, for life and pensions business. Irish Life Assurance plc is regulated by the Central Bank of Ireland.